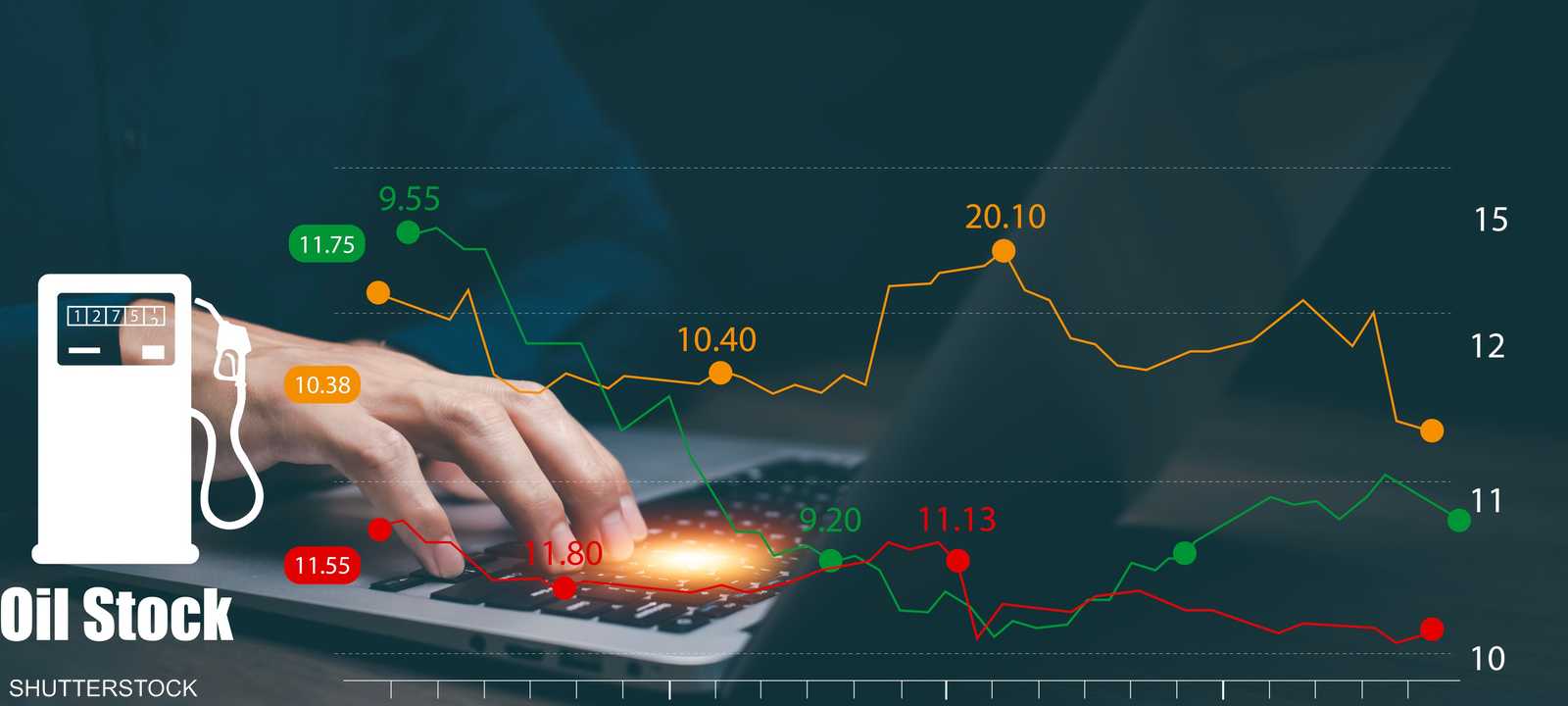

النفط يتجه لتكبد خسائر للعام الثاني على التوالي

النفط

رغم انتعاش النفط في بداية تعاملات الثلاثاء مدفوعًا بنمو نشاط الصناعات التحويلية الصيني، إلا أنه يُواجه عامًا آخر من الخسائر بسبب ضعف الطلب العالمي خاصة في الدول الأكثر استهلاكا.

تحرك الأسواق

ارتفعت العقود الآجلة لخام برنت 47 سنتا، أو 0.7 بالمئة، إلى 74.46 دولار للبرميل، بحلول الساعة 0130 بتوقيت غرينتش.

وزاد خام غرب تكساس الوسيط الأميركي 49 سنتا، أو 0.7 بالمئة أيضا، إلى 71.48 دولار للبرميل، بحسب بيانات رويترز.

وعلى مدار العام، انخفض خام برنت 3.2 بالمئة، في حين تراجع الخام الأميركي 0.6 بالمئة.

وأظهر مسح رسمي للمصانع الثلاثاء نمو نشاط الصناعات التحويلية في الصين للشهر الثالث على التوالي في ديسمبر، وإن كان بوتيرة أبطأ، مما يشير إلى أن التحفيز الجديد يساعد على دعم ثاني أكبر اقتصاد في العالم.

ورغم أن توقعات الطلب الضعيفة في المدى البعيد تضغط على الأسعار، فإنها قد تجد دعما في الأجل القصير من تراجع مخزونات الخام الأميركية التي من المتوقع انخفاضها بنحو ثلاثة ملايين برميل الأسبوع الماضي.

وتلقى خام برنت وخام غرب تكساس الوسيط الأميركي دعما من انخفاض أكبر من المتوقع في مخزونات الخام الأميركية في الأسبوع المنتهي في 20 ديسمبر مع تكثيف المصافي لنشاطها وزيادة الطلب على الوقود بفضل موسم العطلات.

Source link